|

|

(If they correctly guess the letters that have been starred out, it’s quite likely the title of this post will attract the attention of the Neteller staff that are following my Twitter feed. If it does, how about finally answering my questions please?)

There’s a difference between a wannabe bank not being able to do bankish things, not being able to add up correctly or having generally useless support staff, and one that makes you feel like a crook while you’re the one getting robbed.

Neteller frequently winds me up because they give two or more different answers to the same question and won’t let me get at my US Dollars without transferring them via at least two other currencies first. Or they act all concerned for a moment but then never get back to you when you ask serious questions. Yet somehow I’ve never really been that worried about leaving significant sums of money in their hands.

However, when I attempted to withdraw some money from Moneybookers to a US bank account recently, they decided to treat me like a criminal, froze my account and now won’t give me any information – or my money.

It’s definitely worth pointing out that their withdrawal page actually suggests withdrawing to a US bank account as an option. I wasn’t trying to subvert the system, for once.

Here’s another important point: while Moneybookers is a popular online payment method for gamblers, I’ve never actually used my account for gambling. I’ve used it to receive payments for a business service which, in one case, just happened to be from someone whose email address has the word “poker” in it.

That probably means I’m a terrorist.

After my first attempt to withdraw, this is what they said:

Please be kindly informed that according to our Terms and Conditions with which you agreed upon registration of your Moneybookers account we are strictly forbidden to allow gaming funds to be withdrawn to US bank accounts as such payments are restricted due to the legislation in the USA.

Please be kindly informed that according to our Terms and Conditions with which you agreed upon registration of your Moneybookers account we are strictly forbidden to allow gaming funds to be withdrawn to US bank accounts as such payments are restricted due to the legislation in the USA.

The email refers me to sections 6.6 and 7.5 of the T&Cs. The first section has nothing to do with this and the second one doesn’t even exist.

It does say the terms were updated on November 6th and I can’t find an older copy, so this is very worrying. Although the (current) terms say that they’ll give you two months notice by email of any changes, it doesn’t look like they even tell their support staff when they decide to change the rules.

This time, I don’t think it particularly matters that they’ve pulled a switcheroo on me and I don’t have a printed copy to back up what I thought I’d agreed to – because even under the current terms, I’ve done nothing wrong.

However, if you use Moneybookers you might like to review the T&Cs – and then ask them why nobody told you they had changed.

I duly replied to tell them that this was not illicit gambling money – assuming that having received several months of payments for the same amount on the same date it would be quite obvious I was telling the truth. They asked to see some photo ID and a copy of a recent bill – pretty standard stuff, which I did – but then:

In order to be able to complete the account verification procedure we would kindly ask you to provide us with some more information about the purpose of receiving payments via our services.

Would you please provide us the URL of your website and a brief description of the services you offer.

Well, frankly, what the fuck business is it of theirs?

I sent them a link and simply said “web hosting” after typing and deleting something to the effect of the line above. The equivalent of muttering under your breath in an email.

I thought that when they replied to say:

We are writing to inform you that your account has been successfully verified.

that that was that. They did point me towards section 11.2 of the T&Cs, which does exist this time but stipulates a restriction on residents of the USA from receiving gambling funds. This couldn’t be more irrelevant, so I tried again to get my US Dollars out – after all, why would they still offer me a US bank withdrawal option if it wasn’t actually possible after I’d jumped through these hoops?

And then this:

We are writing to inform you that your account is under audit. Once the audit has been completed we will be in contact.

Here’s where it starts to get stupid. I said:

What does this mean? I thought I’d just been through your verification process

And they replied.

Please be kindly informed that your your account is under audit. As soon as the audit has been completed we will contact you.

It’s only because they changed the wording slightly in the second reply that I knew it was a real person fucking with me, not just a stupid autoresponder. I tried again:

This is identical to the last message I received. Can you please let me know what this means? I have literally 3 transactions to audit.

And the last thing I had from them by email was:

We transferred your case to our security department and they should be getting back to you in the next 48 hours with more information about your account.

Two weeks, and three phone calls later, my money is still locked up in Moneybookers’ private jail, and I have no visitation rights.

This morning, all I could get out of them was that they’d make a note on my account and pass it to the security department as a matter of urgency. I would hear back from them probably today, or at the latest tomorrow.

That’s exactly what they told me last time, but today I was told there was no such note on my account from any previous call.

I don’t really know what to think. This should not be hard.

If you don’t allow withdrawals to the US, don’t offer it as an option. If you still have cold feet about letting me withdraw to the US after telling you what you needed to know, then just say so and I’ll withdraw to the UK. If you absolutely have to audit my account, go ahead. It should take about thirty seconds.

But don’t be stealing my money with no good reason.

Because if you do, I’ll write about it on the internet and expose your shenanigans to, on a good day, dozens of people.

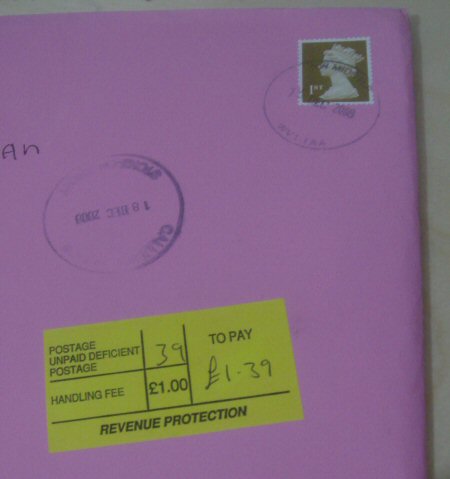

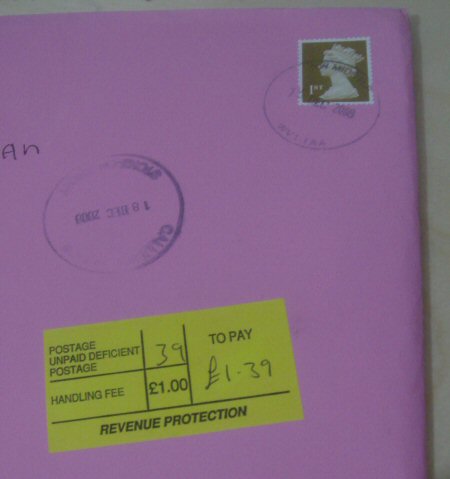

This card is apparently a "large letter". Miserable bastards.

I had to go and collect it too after they left me a card that suggested I had something important waiting for me.

The postman didn’t even knock to see if I was in. I’m sure they try to avoid confrontation with this kind of festive penny pinching.

However I did get a good dose of Christmas cheer when I popped into Sainsbury’s on my way home, where I heard this announcement. Probably for a dare.

"Having a Christmas party?

We’ll save you the mither

Cos we’ve got party food

Two for a fiver."

Brilliant.

I finally received a response from the Financial Ombudsman Service this morning about the fiasco I had trying to get a refund to my credit card after MaxJet went bust (which is now almost a year ago) and I had to rebook two flights to Las Vegas.

I’d paid on an MBNA credit card, and their position all along was that I couldn’t have a refund until I’d actually been unable to travel as planned, despite the airline telling customers that they absolutely would not be flying. In other words, I had to wait for each departure date to pass before I’d get my money back.

In this respect, MBNA were true to their word and did post the refunds shortly after the start of each trip. However it meant I was waiting three months for some of it and seven months for the rest and as far as I could tell there was no legitimate reason for them not refunding immediately.

I’d read plenty of accounts online about other travellers getting their money back straight away from reputable banks – including those who had booked on a debit card, which does not carry the same level of consumer protection as a credit card.

So I was having none of it. After I made an official complaint and MBNA stood firm, I took it to the Financial Ombudsman Service.

FOS are slow. I complained on March 10th, after which I had four separate letters telling me they were very busy and would look at my complaint eventually. Which, eventually, turned out to be more than 7 months later.

I’d had all my money back in July but being the stubborn bastard that I am, I told FOS that I still wanted them to process the complaint.

I had also suggested that MBNA should still be liable for the difference in cost because of the more expensive flights I booked as an alternative under the Consumer Credit Act, which they have tried so hard to pretend doesn’t apply to them.

It looks like it was worth the wait. The FOS adjudicator has sided with the law, rather than MBNA’s interpretation of "MasterCard guidelines".

Although they made an adjudication last month I only received a copy of it today because MBNA have (predictably) rejected this suggestion that they pay me money. So it’s now being referred to an actual ombudsman, rather than a henchman, who will make a legally-binding decision.

This could still take months, but I don’t care.

It’s super satisfying (assuming the ombudsman does reach the same conclusion) because if MBNA had simply given me a refund straight away (like they were meant to) I almost certainly wouldn’t have bothered doing anything to recover the cost difference.

The adjudicator also decided I should have the amount rounded up by about £150 as compensation for having to wait for the refund. Which is nice.

The only reason I still have this credit card is because I can earn BMI miles on everything I spend, but with the Lufthansa takeover looming and the possibilty of Diamond Club getting swallowed up by their programme as well as the cancellation of BMI’s transatlantic flights next year, I’ll probably be doing away with it soon.

Sadly, MBNA won’t miss me as a customer. I’ve never paid a penny of interest on that card.

Anyway, if you’re interested in seeing what FOS had to say about these shenanigans, here are copies of the letter I had today and the adjudication sent to MBNA (click to enlarge).

On Sunday, I went to see the NFL International Series game at Wembley. It’s kind of a big deal to take a meaninful American Football game to Europe, even if it was only a meaningful game for one team.

We were subjected to many reminders that this year was the anniversary of the 1972 Miami Dolphins perfect season. By definition, isn’t every year an anniversary? I had to work out that it’s the 35th all by myself – the much celebrated Coral anniversary. Yesterday’s game went to form though, making it eight straight losses for Miami and putting them half way towards the wrong kind of perfect season.

The day in pictures:

|

|

Executive flip-down seating with beverage holders.

|

|

Random pre-game entertainment: Cheerleaders, The Feeling and some giant shirts.

|

|

|

Dolphins warm up. Watching this from a distance it looks like a party in The Sims.

|

|

Fireworks as the teams run out on the pitch for the third time.

|

|

|

Miami throws up a prayer.

|

|

The Great British weather in attendance.

|

These photos were taken from my £125 "exclusive" Club Wembley seat. After missing out on three separate ticket ballots, I was well and truly suckered in by a masterpiece of marketing that goes a little something like this:

1. Release tickets in small chunks to create mass hysteria

2. Wait to see how much those tickets sell for on eBay (answer: up to £300 a pair)

3. Magically find another 17,000 tickets and set the price only ever-so-slightly lower than people are paying to the touts.

Wembley’s list of prohibited items is not vague about some of the things you’re not allowed to take in. Obviously weapons are not allowed, but I had to wonder what incident had led to the specific inclusion of darts on that list, and whether it involved a comedy head trauma.

Although not on the list, it seems they have also a problem with bottle caps – apparently they can be used as offensive weapons. Could someone please show me how? I’m willing to sustain a considerable wound in the interests of getting an answer to this.

I’m not talking about metal beer bottle caps, which could probably inflict quite a nasty scratch, but plastic screw-on caps from bottles of pop.

I found out about this right at the turnstile. Bored Security Goon #1 patted down my arms but decided he didn’t want to go any lower. Not a problem. Nobody keeps a dart in their pocket anyway, it’s always in the sleeve. He was more interested in the half-drunk bottle of water in my bag.

– "Sir I see you have a bottle there and we can’t allow any bottles with caps inside".

– "Oh. Why?"

– "Because it could be used as an offensive weapon."

I unscrew the offending sports cap. This kind actually could be used to create a water-pistol like jet if I squeezed the bottle really hard. "What, this?" I ask, trying to hold it threateningly. BSG#1 just ignores me and waves me through.

So I now have a capless bottle of water in one hand and the lethal cap of death in the other. If only I could work out how to put this darn thing back together.

Well, I nearly got away with it but Bored Security Goon #2 piped up as I walked past him, "Take a sip of your water please". Ok fine. This actually makes some sense. "Now finish it up and throw the bottle in this bag".

Logic has left the building.

Upstairs we’re greeted by a couple of fake cheerleaders who sign me up for a prize draw to win, wait for it, some cufflinks. I’m already too confused to argue so I just do what I’m told. Claire was signed up for the prize draw too. Apparently the female prize is also cufflinks.

I went to buy a drink inside the stadium. Nervous Guy assistant kindly opened my bottle of coke for me. "Can’t I have the caps?", I asked while he struggled to work out my change from a twenty. I’d actually bought two drinks, and his training hadn’t covered that yet. As he handed the caps back with a shrug, something rumbled in the distance as I realised I probably just got him fired.

I really don’t like it when someone talks to me like I’m fucking five years old. Especially when I’m not acting it. I’d already tried to get to my seat to be told "you can look through the window if you want but you’re not allowed in". Now, we meet Bottle Bitch.

– "You can’t have the cap"

– "Why?"

– "Because… well I think you know why".

For fucks sake, seriously? Was it such a retarded question? I really, honestly don’t know.

– "You could throw it onto the pitch"

I hadn’t seen my seat yet, but I figured I’d need quite an arm to tickle the sideline with a tiny piece of plastic.

Claire and I had a bottled drink each, and while we started pointing out many other things that were much easier to make into a missle – including the handful of change that Nervous Guy had finally worked out – she swooped in and snatched away one of the caps.

Just one. And as much as I wanted to, I just couldn’t work out how to kill someone with the other.

A word of warning to anybody who is looking for a Las Vegas package deal with Virgin Holidays – don’t get excited too soon when you drop on a bargain deal online. In fact, to be safe you should probably wait until you step onto the plane before you start counting down the days. T minus, err, zero.

I found out just what a gamble they can be by trying to book a holiday for my sister. She’d already booked the week off work and found a deal on Expedia for about £500 each, then called me to ask if it was a good deal or if could I do better.

Now that’s a challenge I can never refuse…

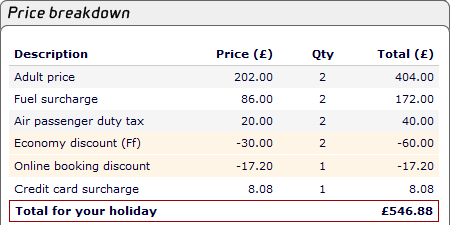

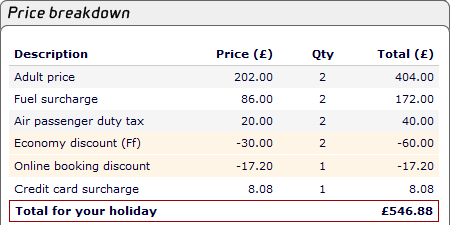

I thought I’d done exceptionally well when I found this deal with Virgin for two return flights and seven nights at the Luxor:

£546 would be a phenomenal price for just the flights, never mind with a week’s accomodation into the bargain too. At this price it was either an insane promotion or it was priced wrong. Either way, I was going to try to take advantage of it.

Laura found out that it was a mistake the same evening when she got a phone call telling her that the price on the web site was actually for just the accomodation and would she like to add on the flights now for another £500+ each. The answer was obviously "no".

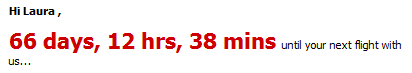

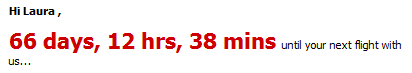

I don’t completely believe their story. The breakdown above shows line items for air passenger duty (although only £20 each, when it costs £40 just to leave the country), a fuel surcharge and an economy seat discount. This all suggests that the flight is included in the total. It even let me log in to the Virgin Atlantic site and select seat reservations, where it also cruelly showed a countdown to a holiday that didn’t really exist:

But the chances of them honouring the published price are, as you might expect, zero. Option one was to cough up for an overpriced flight. Option two was to forget it ever happened.

Now, more than three weeks after cancelling, I’m still waiting for a refund. In fact it was only after I called the bank and they set up a three-way phone call to find out what was going on that we got any joy at all. What a shambles. Even then, they tried to deduct a £120 per person cancellation fee. I don’t think so…

OK, so I knew all along that something had probably gone wrong and that they might try to get out of this booking, but it did reveal a frightening feature of the Virgin Holidays online booking system.

Once you fill in all the information on their web site, including payment details, you still have to wait up to fourteen days for written confirmation of the booking. Until it arrives, you just don’t know for sure whether or not you have a holiday. They can still cancel it at any time.

Even if they charge your credit card, even if they book you a seat on the damn plane, they can still change their mind.

While I would expect that in most cases they’re probably not interested in simply cancelling your booking just because they can, what’s to say they wouldn’t pull the plug on your package deal if your plane suddenly became very popular and they could make more money selling it as flight only (which, as far as I can tell, is a confirmed booking the minute you press submit). A delay of up to two weeks for confirmation of a flight booked online is just not good enough.

In the end Laura rebooked with MyTravel for £294 each and snubbed the rock-bottom rate I found her for Imperial Palace in favour of the Excalibur for just a little more. Not a bad decision.

Overall, it was still about £200 cheaper than Expedia. Mission accomplished!

I just downloaded my latest credit card statement, and I knew it was going to be big because it’s been a particularly extravagant month.

I’ve booked two Vegas trips for myself and one for my sister (I’m sure you’ll hear more about this), plus enough first class train tickets to requalify for Virgin Traveller. Apparently I’ve been to Cheltenham five times this week, who knew?

There’s also all my new office furniture. My desk is up, and it’s all the right colour, and it turned out to be a marvel of engineering. The Hoover Dam of desks. The lady in Ikea said it would never work, that it’s just not meant to go that big. I’ve proved her wrong just by using two steel tubes and one extra leg. The over/under on it collapsing is three weeks.

Then there’s all the other random crap that usually goes on there, which this month included car insurance renewal and, obviously, Spice Girls tickets.

New Balance: £4,983.46

Minimum Payment: £9.20

Not forgetting the really important bit:

BMI Diamond Club Miles earned: 7,313.04

I really wouldn’t mind if they rounded down the point zero four miles, that won’t get me very far.

So let me get this straight. Even if there was no interest on this card I would be paying it off at just over nine quid a month, which would be 542 monthly installments – a mere 45 years to clear the balance.

Given that if you pay your credit card automatically by direct debit you have just two options – full balance or minimum payment – this special rate (the card terms say the minimum payment should be 3% of the balance – nearly £150 in this case) has to be a crafty angle they’re shooting to try to rack up a lifetime of interest. Or at least a couple more months until you realise what they’re up to.

Can anyone lend me five grand?

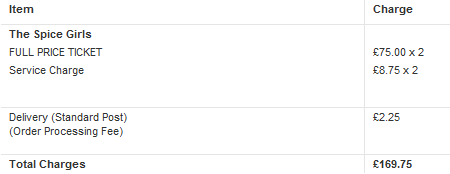

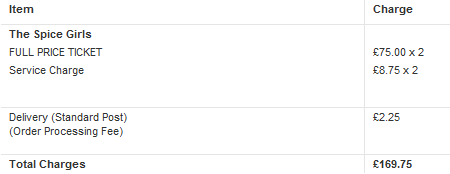

I got Spice Girls tickets! And corkers they are too. Block 106, row D – actualy facing the stage. That almost never happens.

Stopped laughing at me yet? OK. Now for the obligatory rant about Ticketbastard fees.

There are so many great advantages to trading online. Having a global presence without needing premises; staying open around the clock without needing extra staff; never needing to actually speak to customers. Reduced overheads produce savings that can be passed on to make you more competitive. At least that’s how it should be.

Absolutely everything you can buy is cheaper on the internet, except for concert tickets. But when the only way you can buy tickets is online and one site has a monopoly, they don’t need to be competitive.

My two £75 tickets cost £169.75. You’re laughing again, aren’t you?

The £2.25 charge for "standard post" I can almost live with. Who doesn’t inflate their shipping costs to build in a little extra profit when they’re selling junk on eBay? I know I do, so it’s a bit hypocritical to take issue with an overpriced stamp.

But the "service charge" on this was the fattest I’ve ever seen. £8.75 on each ticket! Where the hell does that come from? There must be a human involved in the process somewhere along the way so we can’t deny them a little something towards their expenses. And sure, it’s a business so they’re going to want to make money by adding a booking fee. Come on though? A surcharge that’s the same price as a CD (delivered) for every person who goes to a concert?

Here’s the official explanation:

This Service Charge (otherwise known as a Convenience Charge or Booking Fee) is a fee that covers costs that allow Ticketmaster to provide the widest range of available tickets while giving you multiple ways to purchase. Tickets are available in many towns and cities via local ticket outlet locations, our Call Centre and ticketmaster.co.uk.

What a crock of shit. These tickets were only available online – you needed to be selected to get sent a password to stand a chance of booking – and the first batch sold out in 38 seconds this morning. Where’s the convenience in having to be online at 10am on the dot to have to fight through the booking process in record time and take whatever tickets you’re lucky enough to have thrown your way? If you decide you don’t like the look of the seats it’s picked for you and want to try again, you’re probably going to miss out.

Similarly, if you come up against an impossible Turing test, like these, you’re pretty much buggered.

Apparently if you relax your eyes, you can see a helicopter in the one on the right.

Tickets from the first show raked in £175,000 in booking fees in under a minute. Then three more dates were announced, and then four more. Overall the juice on just those eight shows heading into the pockets of Ticketmaster shareholders is £1.4 million – I think somebody just got a new yacht. It’s not exactly skilled work stuffing tickets into envelopes. The fees I paid on just two tickets could fund three hours of minimum-wage labour. Plenty of time, even if their equal opportunities policy demands the use of partially-sighted amputees with Parkinson’s disease. It’s somewhat generous.

What’s most annoying is why is the service charge for this is so much higher than for other tickets? Am I somehow getting a much better service than I would, for instance, with my £12 face value ticket to see The Donnas next month (and I’m really not ashamed about that either), which carried a £1.20 fee? The postage on those was cheaper too, at £1.75. Are the Spice Girls tickets really heavy?

Seriously, if people have been successfully taking their banks to court to claim back unreasonable charges for overdrafts I might start keeping a tally of just how much Ticketmaster has ripped me off and see if I can’t do something about it. It would probably pay for my next car.

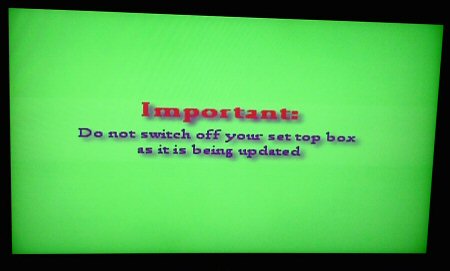

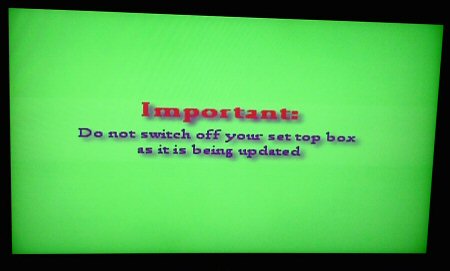

After nearly a week without Big Brother, our cable box has finally fixed itself.

Well, when I say fixed itself, that’s not strictly true. They told us everything would work itself out in the end, but in fact it took yet another call to Virgin Media to get anywhere. This time they eventually told me the trick to resetting the box and making it perform an emergency recovery – something that I now learned would actually have been possible on Friday. Had I bothered to look into the deepest corners of their web site, I’d actually have found this myself.

It’s a shame that technical supportings didn’t know where to look for this piece of information, rather than just telling me to please be patient sir. The trick, for future reference, is not to report a fault but to ask to cancel. Then answers suddenly seem to appear.

I don’t watch a lot of TV these days, but even I’m going to notice a complete blackout that lasts more than a day.

The screen was like this yesterday tea-time when we sat down to catch up on Big Brother, and it’s the same story today.

Of course, I’ve switched the box on and off a couple of times since then. Very naughty, but come on – a day to do a software update? I just didn’t believe it.

I dreaded making the phone call, but it couldn’t be put off any longer. However I did learn a couple of things.

Firstly, while on hold for an impressive 28 minutes as my call was transferred from the wrong Indian call centre to the right one, I learned that I am perfectly capable of eating a chicken kiev with one hand. Using a fork, obviously, but I was very pleased with this newly discovered skill.

I also learned that despite having a set top box that says Virgin Media on the front, all the on-screen menus saying Virgin Media all over them and the fact that I get bills in the post from Virgin Media every month, I am in fact a not a Virgin Media customer. I’m aparently with NTL – a company I didn’t think existed any more. As Virgin seem to not have any customers of their own, the number on their web site (that’s the same web site you get to when you type in www.ntl.com or Google for "NTL"; or go to www.telewest.com, or Google for "Telewest") is probably just another call avoidance tactic.

The verdict, which may as well have been relayed on a recorded message that said "we realised we broke it", was that this problem has been affecting many customers since 4.30pm yesterday, and the engineers have said it should be fixed by 5.30pm today.

This was at 7pm.

So that twenty-five hour timeframe they’d given themselves to restore a fundamental service – in fact the primary reason for their business – just wasn’t long enough. If that’s how seriously they’ve been taking it so far then why on earth should I expect them to do anything about it before Tuesday, now that the bank holiday weekend has started?

I don’t think it’s overly sensational to call this a major fuck up. As much as I relished the prospect of leaving Sky and not paying them any more money to spend on outbidding the BBC to take shows like 24 and destroy them with commercials that aren’t even in the right places, there were never any problems with actually being able to watch TV.

If the Halifax former building society want to be treated like a bank, they should act like one. There we are with a hundred quid in silver, saved up over many years in a Cadbury’s Roses jar, and she’s all like "only five bags a day". It does say this on the counter too. But I mean, how much effort is it really? They don’t count the coins. They don’t even have to pour them into a sorting machine. She took my five bags behind a partition and presumably weighed them, as the whole thing only took about 30 seconds – including the walk. It might have taken 40 seconds if she’d accepted my full deposit.

Apparently this restriction doesn’t apply to kids’ accounts. Clearly high revenue earners for the banks, children. Especially the ones who have a freaking mortgage with them, like me.

I’m not done though. Sorry, there’s more.

PayPal. For crying out loud.

Last week I attempted to get a refund on a transaction from a seller that has proved to be less than honest. Claire found a nice little sideline in used printer cartridges, buying them from eBay and either recycling at a profit, or sending them to Tesco for 100 Green Clubcard points each – that’s £4 a pop if you use the points towards a Virgin holiday to you know where, or some other Clubcard Deals. I paid through PayPal using my MBNA credit card to earn BMI diamond club miles, towards yet another holiday to you know where.

I have no problem with naming and shaming here. Hopefully search engines will pick this up so that anybody who wants to check out the seller will find our story: Image Warehouse (eBay name imagewarehouse) sold a box of empty Lexmark inkjet cartridges that were just not up to the job. Listed as virgin (not yet refilled) and official, they were mostly neither – a box full of poor quality "compatible" cartridges that were in no state to be recycled. Some of them had literally fallen apart.

The seller agreed that we could return the box for a refund, which in itself cost about £60. Since then he’s not responded to a single email, despite still apparently doing a healthy business on eBay. Right now, he’s had 17 negative comments in the last month, but he shifts enough stuff that this only equates to a 99.3% positive feedback rating. Most buyers wouldn’t even look any further than that.

The problem with PayPal – for buyers dealing with another country, at least – lies in the fact that they will only open a dispute within 45 days of purchase. These cartridges were sent surface mail from the USA so took about five weeks to arrive. After sending them back, it was clearly way past 45 days before we could be sure that the guy was ripping us off. PayPal won’t help and Mastercard won’t start a chargeback over a "quality of goods issue", even though I have emails stating he would refund and proof of shipping. That just encourages honest citizens to lie to their bank and say that it’s a fraudulent transaction, surely? Telling the truth sure as hell doesn’t do any good when the "buyer protection" policies just aren’t worth a damn. We’re pretty much screwed on this one.

On the other hand…

I’ve also been on the seller side of a dispute. A web site I took over a few years ago included a store that sells downloadable software and web traffic. It’s far from being a retirement plan, but it does get the occasional order. The software sales work just fine, but since it’s way down my priority list, I’ve not bothered to keep up to date with traffic prices from various suppliers that I’d resell from and I’ve not accepted an order for some time. I actually care about this web site so little that, rather than hack about with a mess of a web site, I just decided to put a message at the top of the page saying that these products weren’t unavailable. Unashamedly cheap, but I thought it might do the job.

You can see the message here: http://www.arrayal.com/wholesale_web_traffic.shtml

It’s not subtle, is it?

Still, I got an order last month for $129.95 and about an hour later – as it didn’t instantly arrive – the buyer put in a complaint with PayPal. Doing so locked those funds pending a review so I couldn’t use them, even to send a refund. As the buyer clearly couldn’t be bothered to read the massive red text warning, as far as I was concerned he could wait a little while for his refund now – I wasn’t going to make a deposit in order to pay him back and then wait weeks while PayPal decided if I could have my money back, or if he’d actually get refunded twice.

The only option for any kind of communication open to me was to submit tracking information for the sale. I did this, selecting delivery method "online" and tracking number "none", and wrote a message in the comments field to explain that this actually wasn’t tracking information, but it was all I could do. The email confirmation they sent after submitting the information did not contain the comments I’d entered, nor were they visible anywhere in the PayPal screens. I’m not sure if anyone ever read these – it doesn’t look like it – and obviously I don’t have an exact copy, but from memory it went a little something like this:

"This product ordered is not available at present, as is stated clearly on the order page. Buyer needs to pay more attention before entering payment details online. Please refund the buyer in full – I cannot do this as the funds in my account are frozen."

Weeks pass, and I hear nothing. Then this:

"According to the User Agreement, PayPal’s Buyer Complaint Policy applies only to the postage of goods and not to services and other intangible goods. For that reason, we are unable to take any action regarding this complaint."

Result? Err… no.

Now it’s his turn to be screwed by a brain dead PayPal policy that, really, is an open door to online fraudsters. If someone is prepared to send you money with PayPal for anything that you don’t have to ship (software, a web site subscription, an e-book, etc) then you simply do not have to deliver and the buyer has no comeback at all. Why not try it? There’s a lot of money to be made if you’re that way inclined.

This result in my favour is no consolation to me really. I could keep the $129.95 to offset what I’ve lost on the other deal, but then I’d be as bad as Ron from Image Warehouse. I’m still going to refund this poor sucker eventualy. First I just want to make sure he knows how fucked up PayPal really is. (*)

(*) I considered censoring my language here, in case it jeopardised search engine indexing, but a quick search for "paypal fucked up" reveals that I’m not the first to say it, and that it’s just fine and dandy with Google. Good job.

|

|

Comments